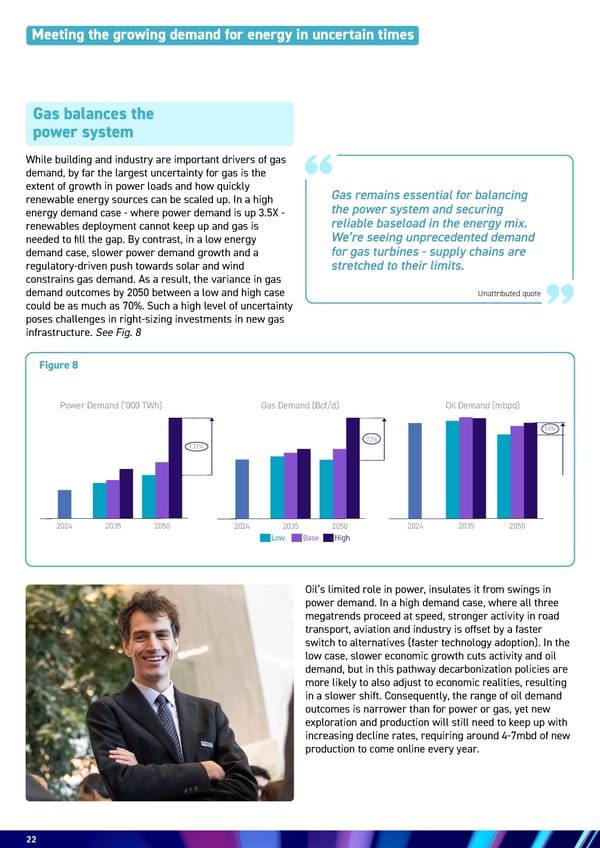

22 22 While building and industry are important drivers of gas demand, by far the largest uncertainty for gas is the extent of growth in power loads and how quickly renewable energy sources can be scaled up. In a high energy demand case - where power demand is up 3.5X - renewables deployment cannot keep up and gas is needed to fill the gap. By contrast, in a low energy demand case, slower power demand growth and a regulatory-driven push towards solar and wind constrains gas demand. As a result, the variance in gas demand outcomes by 2050 between a low and high case could be as much as 70%. Such a high level of uncertainty poses challenges in right-sizing investments in new gas infrastructure. See Fig. 8 Oil’s limited role in power, insulates it from swings in power demand. In a high demand case, where all three megatrends proceed at speed, stronger activity in road transport, aviation and industry is offset by a faster switch to alternatives (faster technology adoption). In the low case, slower economic growth cuts activity and oil demand, but in this pathway decarbonization policies are more likely to also adjust to economic realities, resulting in a slower shift. Consequently, the range of oil demand outcomes is narrower than for power or gas, yet new exploration and production will still need to keep up with increasing decline rates, requiring around 4-7mbd of new production to come online every year. Gas balances the power system Figure 8 Unattributed quote Meeting the growing demand for energy in uncertain times 131% 2024 2035 2050 72% 2024 2035 2050 14% 2024 2035 2050 Low Base High Power Demand (’000 TWh) Gas Demand (Bcf/d) Oil Demand (mbpd) Gas remains essential for balancing the power system and securing reliable baseload in the energy mix. We’re seeing unprecedented demand for gas turbines - supply chains are stretched to their limits.

Energy & AI: Twin Engines Turbo-Charging Economic Growth Page 21 Page 23

Energy & AI: Twin Engines Turbo-Charging Economic Growth Page 21 Page 23