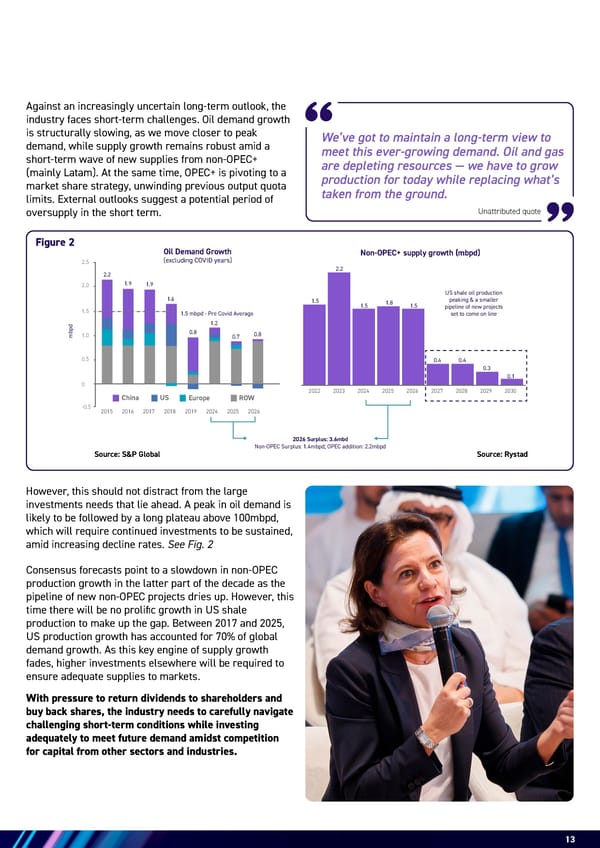

13 We’ve got to maintain a long-term view to meet this ever-growing demand. Oil and gas are depleting resources — we have to grow production for today while replacing what’s taken from the ground. 13 Against an increasingly uncertain long-term outlook, the industry faces short-term challenges. Oil demand growth is structurally slowing, as we move closer to peak demand, while supply growth remains robust amid a short-term wave of new supplies from non-OPEC+ (mainly Latam). At the same time, OPEC+ is pivoting to a market share strategy, unwinding previous output quota limits. External outlooks suggest a potential period of oversupply in the short term. Consensus forecasts point to a slowdown in non-OPEC production growth in the latter part of the decade as the pipeline of new non-OPEC projects dries up. However, this time there will be no prolific growth in US shale production to make up the gap. Between 2017 and 2025, US production growth has accounted for 70% of global demand growth. As this key engine of supply growth fades, higher investments elsewhere will be required to ensure adequate supplies to markets. With pressure to return dividends to shareholders and buy back shares, the industry needs to carefully navigate challenging short-term conditions while investing adequately to meet future demand amidst competition for capital from other sectors and industries. Unattributed quote However, this should not distract from the large investments needs that lie ahead. A peak in oil demand is likely to be followed by a long plateau above 100mbpd, which will require continued investments to be sustained, amid increasing decline rates. See Fig. 2 China US 1.2 0.8 1.9 1.6 2.2 1.9 1.0 1.5 2.5 2.0 0 0.5 mbpd Oil Demand Growth (excluding COVID years) Europe ROW -0.5 0.7 0.8 2024 2019 2017 2018 2015 2016 2025 2026 2.2 1.5 1.5 1.8 1.5 0.4 0.4 0.3 0.1 1.5 mbpd - Pre Covid Average 2027 2026 2024 2025 2022 2023 2028 2029 2030 US shale oil production peaking & a smaller pipeline of new projects set to come on line 2026 Surplus: 3.6mbd Non-OPEC Surplus: 1.4mbpd; OPEC addition: 2.2mbpd Non-OPEC+ supply growth (mbpd) Figure 2 Source: S&P Global Source: Rystad

Energy & AI: Twin Engines Turbo-Charging Economic Growth Page 12 Page 14

Energy & AI: Twin Engines Turbo-Charging Economic Growth Page 12 Page 14