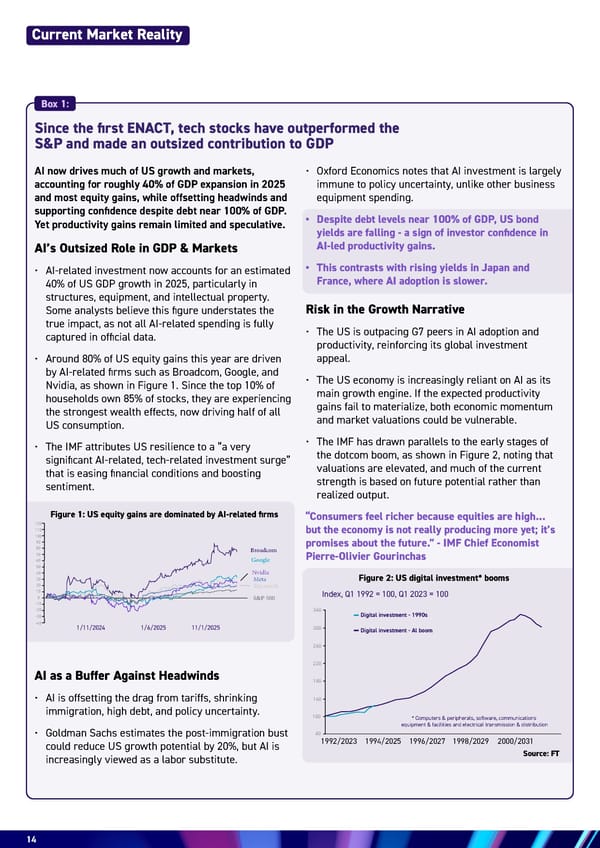

14 Current Market Reality AI now drives much of US growth and markets, accounting for roughly 40% of GDP expansion in 2025 and most equity gains, while offsetting headwinds and supporting confidence despite debt near 100% of GDP. Yet productivity gains remain limited and speculative. AI’s Outsized Role in GDP & Markets • AI-related investment now accounts for an estimated 40% of US GDP growth in 2025, particularly in structures, equipment, and intellectual property. Some analysts believe this figure understates the true impact, as not all AI-related spending is fully captured in official data. • Around 80% of US equity gains this year are driven by AI-related firms such as Broadcom, Google, and Nvidia, as shown in Figure 1. Since the top 10% of households own 85% of stocks, they are experiencing the strongest wealth effects, now driving half of all US consumption. • The IMF attributes US resilience to a “a very significant AI-related, tech-related investment surge” that is easing financial conditions and boosting sentiment. AI as a Buffer Against Headwinds • AI is offsetting the drag from tariffs, shrinking immigration, high debt, and policy uncertainty. • Goldman Sachs estimates the post-immigration bust could reduce US growth potential by 20%, but AI is increasingly viewed as a labor substitute. Since the first ENACT, tech stocks have outperformed the S&P and made an outsized contribution to GDP 1/11/2024 1/6/2025 11/1/2025 90 100 120 110 70 80 60 20 -20 30 -30 50 40 -40 0 10 -10 Broadcom Google Nvidia Meta Microsoft S&P 500 220 260 340 300 140 180 100 60 Index, Q1 1992 = 100, Q1 2023 = 100 Digital investment - 1990s Digital investment - Al boom * Computers & peripherals, software, communications equipment & facilities and electrical transmission & distribution 1992/2023 1994/2025 1996/2027 1998/2029 2000/2031 • Oxford Economics notes that AI investment is largely immune to policy uncertainty, unlike other business equipment spending. • Despite debt levels near 100% of GDP, US bond yields are falling - a sign of investor confidence in AI-led productivity gains. • This contrasts with rising yields in Japan and France, where AI adoption is slower. Risk in the Growth Narrative • The US is outpacing G7 peers in AI adoption and productivity, reinforcing its global investment appeal. • The US economy is increasingly reliant on AI as its main growth engine. If the expected productivity gains fail to materialize, both economic momentum and market valuations could be vulnerable. • The IMF has drawn parallels to the early stages of the dotcom boom, as shown in Figure 2, noting that valuations are elevated, and much of the current strength is based on future potential rather than realized output. “Consumers feel richer because equities are high... but the economy is not really producing more yet; it’s promises about the future.” - IMF Chief Economist Pierre-Olivier Gourinchas Source: FT Figure 1: US equity gains are dominated by AI-related firms Figure 2: US digital investment* booms Box 1:

Energy & AI: Twin Engines Turbo-Charging Economic Growth Page 13 Page 15

Energy & AI: Twin Engines Turbo-Charging Economic Growth Page 13 Page 15