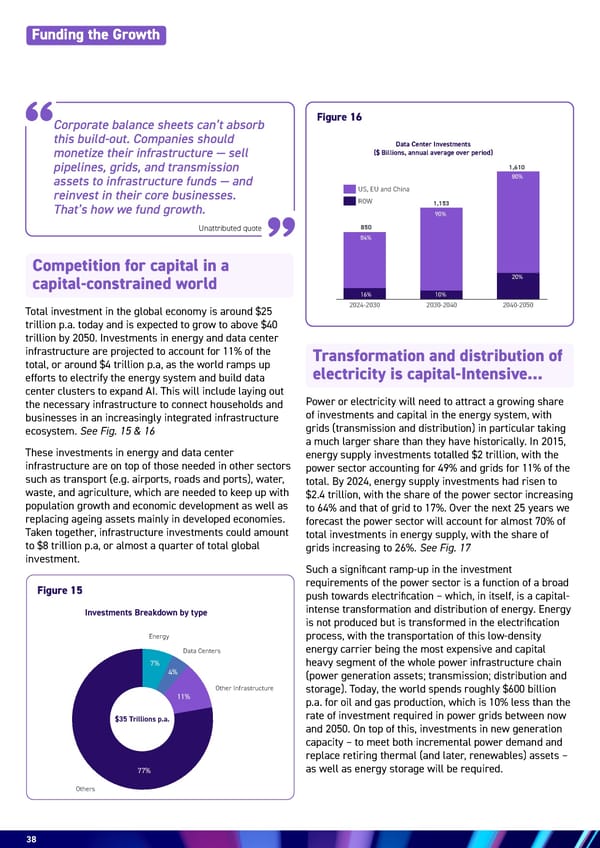

38 Investments Breakdown by type Energy Data Centers Other Infrastructure Others 77% 11% 4% 7% $35 Trillions p.a. Total investment in the global economy is around $25 trillion p.a. today and is expected to grow to above $40 trillion by 2050. Investments in energy and data center infrastructure are projected to account for 11% of the total, or around $4 trillion p.a, as the world ramps up efforts to electrify the energy system and build data center clusters to expand AI. This will include laying out the necessary infrastructure to connect households and businesses in an increasingly integrated infrastructure ecosystem. See Fig. 15 & 16 These investments in energy and data center infrastructure are on top of those needed in other sectors such as transport (e.g. airports, roads and ports), water, waste, and agriculture, which are needed to keep up with population growth and economic development as well as replacing ageing assets mainly in developed economies. Taken together, infrastructure investments could amount to $8 trillion p.a, or almost a quarter of total global investment. Power or electricity will need to attract a growing share of investments and capital in the energy system, with grids (transmission and distribution) in particular taking a much larger share than they have historically. In 2015, energy supply investments totalled $2 trillion, with the power sector accounting for 49% and grids for 11% of the total. By 2024, energy supply investments had risen to $2.4 trillion, with the share of the power sector increasing to 64% and that of grid to 17%. Over the next 25 years we forecast the power sector will account for almost 70% of total investments in energy supply, with the share of grids increasing to 26%. See Fig. 17 Such a significant ramp-up in the investment requirements of the power sector is a function of a broad push towards electrification – which, in itself, is a capital- intense transformation and distribution of energy. Energy is not produced but is transformed in the electrification process, with the transportation of this low-density energy carrier being the most expensive and capital heavy segment of the whole power infrastructure chain (power generation assets; transmission; distribution and storage). Today, the world spends roughly $600 billion p.a. for oil and gas production, which is 10% less than the rate of investment required in power grids between now and 2050. On top of this, investments in new generation capacity – to meet both incremental power demand and replace retiring thermal (and later, renewables) assets – as well as energy storage will be required. Competition for capital in a capital-constrained world Transformation and distribution of electricity is capital-Intensive... Figure 15 Figure 16 Unattributed quote Funding the Growth Data Center Investments ($ Billions, annual average over period) 2024-2030 US, EU and China ROW 2030-2040 2040-2050 84% 16% 850 90% 80% 10% 20% 1,153 1,610 Corporate balance sheets can’t absorb this build-out. Companies should monetize their infrastructure — sell pipelines, grids, and transmission assets to infrastructure funds — and reinvest in their core businesses. That’s how we fund growth.

Energy & AI: Twin Engines Turbo-Charging Economic Growth Page 37 Page 39

Energy & AI: Twin Engines Turbo-Charging Economic Growth Page 37 Page 39