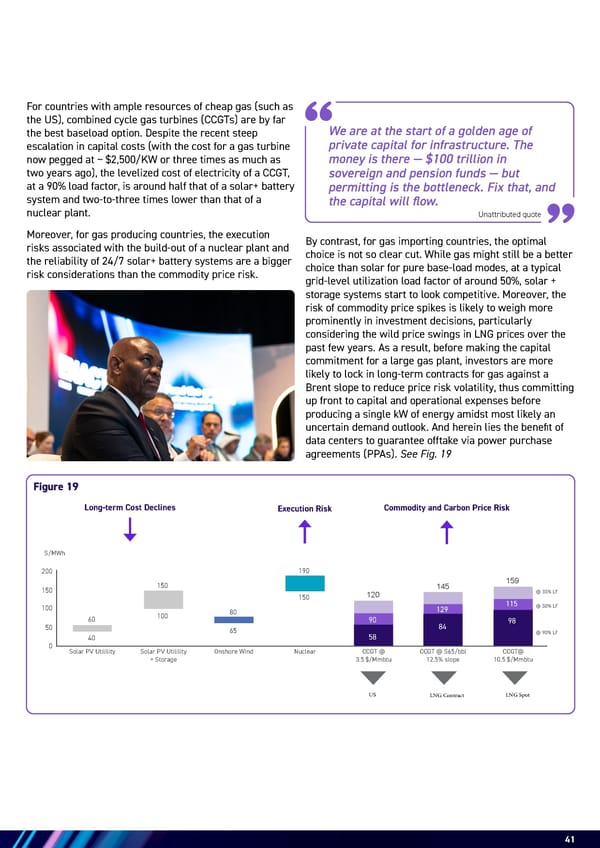

41 Figure 19 58 90 120 84 129 145 98 115 159 CCGT @ 3.5 $/Mmbtu CCGT @ S65/bbl 12.5% slope CCGT@ 10.5 $/Mmbtu US LNG Contract LNG Spot @ 35% LF @ 90% LF @ 50% LF Commodity and Carbon Price Risk Execution Risk Long-term Cost Declines Solar PV Utilility Solar PV Utilility + Storage Onshore Wind Nuclear 190 150 150 100 80 60 S/MWh 200 150 100 50 0 65 40 For countries with ample resources of cheap gas (such as the US), combined cycle gas turbines (CCGTs) are by far the best baseload option. Despite the recent steep escalation in capital costs (with the cost for a gas turbine now pegged at ~ $2,500/KW or three times as much as two years ago), the levelized cost of electricity of a CCGT, at a 90% load factor, is around half that of a solar+ battery system and two-to-three times lower than that of a nuclear plant. Moreover, for gas producing countries, the execution risks associated with the build-out of a nuclear plant and the reliability of 24/7 solar+ battery systems are a bigger risk considerations than the commodity price risk. Unattributed quote By contrast, for gas importing countries, the optimal choice is not so clear cut. While gas might still be a better choice than solar for pure base-load modes, at a typical grid-level utilization load factor of around 50%, solar + storage systems start to look competitive. Moreover, the risk of commodity price spikes is likely to weigh more prominently in investment decisions, particularly considering the wild price swings in LNG prices over the past few years. As a result, before making the capital commitment for a large gas plant, investors are more likely to lock in long-term contracts for gas against a Brent slope to reduce price risk volatility, thus committing up front to capital and operational expenses before producing a single kW of energy amidst most likely an uncertain demand outlook. And herein lies the benefit of data centers to guarantee offtake via power purchase agreements (PPAs). See Fig. 19 We are at the start of a golden age of private capital for infrastructure. The money is there — $100 trillion in sovereign and pension funds — but permitting is the bottleneck. Fix that, and the capital will flow.

Energy & AI: Twin Engines Turbo-Charging Economic Growth Page 40 Page 42

Energy & AI: Twin Engines Turbo-Charging Economic Growth Page 40 Page 42