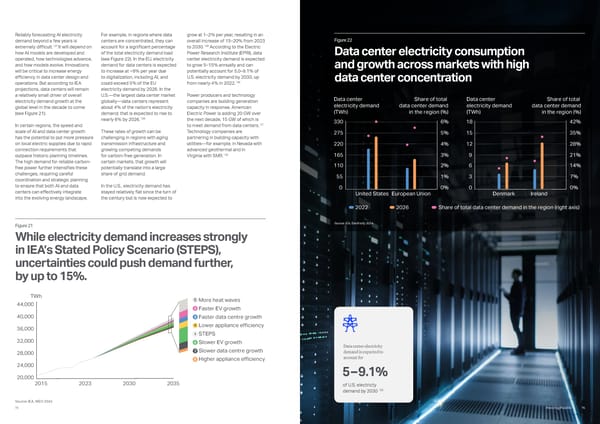

Data center electricity demand is expected to account for of U.S. electricty demand by 2030 130 5 – 9.1% Reliably forecasting AI electricity demand beyond a few years is extremely difficult.127 It will depend on how AI models are developed and operated, how technologies advance, and how models evolve. Innovations will be critical to increase energy efficiency in data center design and operations. But according to IEA projections, data centers will remain a relatively small driver of overall electricity demand growth at the global level in the decade to come (see Figure 21). In certain regions, the speed and scale of AI and data center growth has the potential to put more pressure on local electric supplies due to rapid connection requirements that outpace historic planning timelines. The high demand for reliable carbon- free power further intensifies these challenges, requiring careful coordination and strategic planning to ensure that both AI and data centers can effectively integrate into the evolving energy landscape. Figure 22 Data center electricity consumption and growth across markets with high data center concentration For example, in regions where data centers are concentrated, they can account for a significant percentage of the total electricity demand load (see Figure 22). In the EU, electricity demand for data centers is expected to increase at ~9% per year due to digitalization, including AI, and could exceed 5% of the EU electricity demand by 2026. In the U.S.—the largest data center market globally—data centers represent about 4% of the nation’s electricity demand; that is expected to rise to nearly 6% by 2026.128 These rates of growth can be challenging in regions with aging transmission infrastructure and growing competing demands for carbon-free generation. In certain markets, that growth will potentially translate into a large share of grid demand. In the U.S., electricity demand has stayed relatively flat since the turn of the century but is now expected to grow at 1–2% per year, resulting in an overall increase of 15–20% from 2023 to 2030.129 According to the Electric Power Research Institute (EPRI), data center electricity demand is expected to grow 5–15% annually and can potentially account for 5.0–9.1% of U.S. electricity demand by 2030, up from nearly 4% in 2022.130 Power producers and technology companies are building generation capacity in response. American Electric Power is adding 20 GW over the next decade, 15 GW of which is to meet demand from data centers.131 Technology companies are partnering in building capacity with utilities—for example, in Nevada with advanced geothermal and in Virginia with SMR.132 2022 2026 Share of total data center demand in the region (right axis) European Union United States 5% 6% 4% 3% 2% 0% 1% Data center electricity demand (TWh) Share of total data center demand in the region (%) 275 330 220 165 110 0 55 Ireland Denmark 35% 42% 28% 21% 14% 0% 7% 15 18 12 9 6 0 3 Data center electricity demand (TWh) Share of total data center demand in the region (%) Source: IEA, Electricity 2024. Figure 21 While electricity demand increases strongly in IEA’s Stated Policy Scenario (STEPS), uncertainties could push demand further, by up to 15%. 36,000 40,000 44,000 TWh 20,000 28,000 32,000 24,000 2 3 4 6 5 7 8 More heat waves Faster EV growth Faster data centre growth Lower appliance efficiency STEPS Slower EV growth Slower data centre growth Higher appliance efficiency 1 2023 2030 2015 2035 Source: IEA, WEO 2024 76 Powering Possible 75

Powering Possible 2024: AI and Energy for a Sustainable Future Page 38 Page 40

Powering Possible 2024: AI and Energy for a Sustainable Future Page 38 Page 40