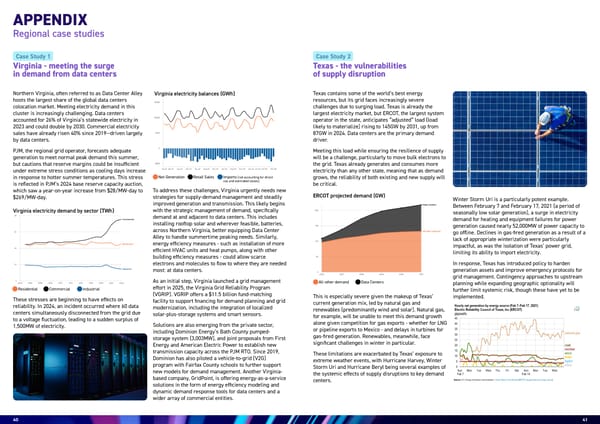

40 41 APPENDIX Northern Virginia, often referred to as Data Center Alley hosts the largest share of the global data centers colocation market. Meeting electricity demand in this cluster is increasingly challenging. Data centers accounted for 26% of Virginia’s statewide electricity in 2023 and could double by 2030. Commercial electricity sales have already risen 40% since 2019—driven largely by data centers. PJM, the regional grid operator, forecasts adequate generation to meet normal peak demand this summer, but cautions that reserve margins could be insufficient under extreme stress conditions as cooling days increase in response to hotter summer temperatures. This stress is reflected in PJM’s 2024 base reserve capacity auction, which saw a year-on-year increase from $28/MW-day to $269/MW-day. Virginia - meeting the surge in demand from data centers Case Study 1 Regional case studies These stresses are beginning to have effects on reliability. In 2024, an incident occurred where 60 data centers simultaneously disconnected from the grid due to a voltage fluctuation, leading to a sudden surplus of 1,500MW of electricity. To address these challenges, Virginia urgently needs new strategies for supply-demand management and steadily improved generation and transmission. This likely begins with the strategic management of demand, specifically demand at and adjacent to data centers. This includes installing rooftop solar and wherever feasible, batteries, across Northern Virginia, better equipping Data Center Alley to handle summertime peaking needs. Similarly, energy efficiency measures - such as installation of more efficient HVAC units and heat pumps, along with other building efficiency measures - could allow scarce electrons and molecules to flow to where they are needed most: at data centers. As an initial step, Virginia launched a grid management effort in 2025, the Virginia Grid Reliability Program (VGRIP). VGRIP offers a $11.5 billion fund-matching facility to support financing for demand planning and grid modernization, including the integration of localized solar-plus-storage systems and smart sensors. Solutions are also emerging from the private sector, including Dominion Energy’s Bath County pumped- storage system (3,003MW), and joint proposals from First Energy and American Electric Power to establish new transmission capacity across the PJM RTO. Since 2019, Dominion has also piloted a vehicle-to-grid (V2G) program with Fairfax County schools to further support new models for demand management. Another Virginia- based company, GridPoint, is offering energy-as-a-service solutions in the form of energy efficiency modeling and dynamic demand response tools for data centers and a wider array of commercial entities. Texas contains some of the world’s best energy resources, but its grid faces increasingly severe challenges due to surging load. Texas is already the largest electricity market, but ERCOT, the largest system operator in the state, anticipates “adjusted” load (load likely to materialize) rising to 145GW by 2031, up from 87GW in 2024. Data centers are the primary demand driver. Meeting this load while ensuring the resilience of supply will be a challenge, particularly to move bulk electrons to the grid. Texas already generates and consumes more electricity than any other state, meaning that as demand grows, the reliability of both existing and new supply will be critical. Texas - the vulnerabilities of supply disruption Case Study 2 This is especially severe given the makeup of Texas’ current generation mix, led by natural gas and renewables (predominantly wind and solar). Natural gas, for example, will be unable to meet this demand growth alone given competition for gas exports - whether for LNG or pipeline exports to Mexico - and delays in turbines for gas-fired generation. Renewables, meanwhile, face significant challenges in winter in particular. These limitations are exacerbated by Texas’ exposure to extreme weather events, with Hurricane Harvey, Winter Storm Uri and Hurricane Beryl being several examples of the systemic effects of supply disruptions to key demand centers. Winter Storm Uri is a particularly potent example. Between February 7 and February 17, 2021 (a period of seasonally low solar generation), a surge in electricity demand for heating and equipment failures for power generation caused nearly 52,000MW of power capacity to go offline. Declines in gas-fired generation as a result of a lack of appropriate winterization were particularly impactful, as was the isolation of Texas’ power grid, limiting its ability to import electricity. In response, Texas has introduced policy to harden generation assets and improve emergency protocols for grid management. Contingency approaches to upstream planning while expanding geographic optionality will further limit systemic risk, though these have yet to be implemented. Virginia electricity balances (GWh) ERCOT projected demand (GW) Virginia electricity demand by sector (TWh) Net Generation All other demand Residential Retail Sales Data Centers Commercial Imports (not accounting for direct use and estimated losses) Industrial

Energy-AI Nexus: Powering the Next Great Leap for Human Progress Page 20 Page 22

Energy-AI Nexus: Powering the Next Great Leap for Human Progress Page 20 Page 22