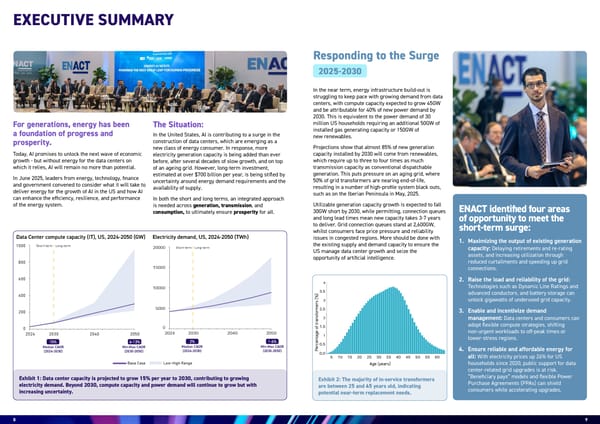

8 9 Today, AI promises to unlock the next wave of economic growth - but without energy for the data centers on which it relies, AI will remain no more than potential. In June 2025, leaders from energy, technology, finance and government convened to consider what it will take to deliver energy for the growth of AI in the US and how AI can enhance the efficiency, resilience, and performance of the energy system. In the near term, energy infrastructure build-out is struggling to keep pace with growing demand from data centers, with compute capacity expected to grow 45GW and be attributable for 40% of new power demand by 2030. This is equivalent to the power demand of 30 million US households requiring an additional 50GW of installed gas generating capacity or 150GW of new renewables. Projections show that almost 85% of new generation capacity installed by 2030 will come from renewables, which require up to three to four times as much transmission capacity as conventional dispatchable generation. This puts pressure on an aging grid, where 50% of grid transformers are nearing end-of-life, resulting in a number of high-profile system black outs, such as on the Iberian Peninsula in May, 2025. Utilizable generation capacity growth is expected to fall 30GW short by 2030, while permitting, connection queues and long lead times mean new capacity takes 3-7 years to deliver. Grid connection queues stand at 2,600GW, whilst consumers face price pressure and reliability issues in congested regions. More should be done with the existing supply and demand capacity to ensure the US manage data center growth and seize the opportunity of artificial intelligence. ENACT identified four areas of opportunity to meet the short-term surge: 1. Maximizing the output of existing generation capacity: Delaying retirements and re-rating assets, and increasing utilization through reduced curtailments and speeding up grid connections. 2. Raise the load and reliability of the grid: Technologies such as Dynamic Line Ratings and advanced conductors, and battery storage can unlock gigawatts of underused grid capacity. 3. Enable and incentivize demand management: Data centers and consumers can adopt flexible compute strategies, shifting non-urgent workloads to off-peak times or lower-stress regions. 4. Ensure reliable and affordable energy for all: With electricity prices up 26% for US households since 2020, public support for data center-related grid upgrades is at risk. “Beneficiary pays” models and flexible Power Purchase Agreements (PPAs) can shield consumers while accelerating upgrades. 15% Median CAGR (2024-2030) 2% Median CAGR (2024-2030) 6-13% Min-Max CAGR (2030-2050) 1-6% Min-Max CAGR (2030-2050) Data Center compute capacity (IT), US, 2024-2050 (GW) Electricity demand, US, 2024-2050 (TWh) 0 400 200 800 1000 600 2024 2030 2050 2040 Long-term Short-term 0 5000 2024 15000 20000 10000 2030 2050 2040 Long-term Short-term Low-High Range Base Case For generations, energy has been a foundation of progress and prosperity. In the United States, AI is contributing to a surge in the construction of data centers, which are emerging as a new class of energy consumer. In response, more electricity generation capacity is being added than ever before, after several decades of slow growth, and on top of an ageing grid. However, long-term investment, estimated at over $700 billion per year, is being stifled by uncertainty around energy demand requirements and the availability of supply. In both the short and long terms, an integrated approach is needed across generation, transmission, and consumption, to ultimately ensure prosperity for all. The Situation: Responding to the Surge 2025-2030 Exhibit 1: Data center capacity is projected to grow 15% per year to 2030, contributing to growing electricity demand. Beyond 2030, compute capacity and power demand will continue to grow but with increasing uncertainty. EXECUTIVE SUMMARY Percentage of transformers (%) Age (years) 3.5 3 4 2.5 2 1.5 1 0.5 0.0 5 10 15 20 25 30 40 45 50 55 60 35 Exhibit 2: The majority of in-service transformers are between 25 and 45 years old, indicating potential near-term replacement needs.

Energy-AI Nexus: Powering the Next Great Leap for Human Progress Page 4 Page 6

Energy-AI Nexus: Powering the Next Great Leap for Human Progress Page 4 Page 6